Often, to optimize business processes and achieve a higher economic result, the owners of several companies decide to merge the business. In this article, we will consider the scalability of the merger process and its basic principles.

What is the merger procedure?

Mergers and acquisitions (M&A) are transactions for the amalgamation of business and capital, which involve the transfer of ownership and change of control over an enterprise. So, how does it work? And how long does a merger take?

A merger is the union of two corporations in which only one of them survives, and the other ceases to exist. As a result of the merger, the acquiring company takes over the assets of the acquired firm. There is also a specific form of merger called consolidation. Consolidation is the combination of businesses in which two or more companies combine to form a completely new company. The merging companies are liquidated and a new legal entity continues to exist.

The pooling of company resources can be caused by such reasons as:

- tough competition and the presence of large players in the competitive environment;

- an alternative way, if it is necessary to liquidate the enterprise due to the increased debt burden, including the option of merging the debtor with the creditor;

- diversification of production by combining companies from different areas of activity;

- low profitability or negative reputation of one of the organizations, the management of which does not want to liquidate the business project.

After agreeing on the details of the upcoming merger, within the management level of each of the enterprises, a general meeting is held for all participants in the reorganization. The conditions of the merger are discussed there, a draft version of the charter of the new enterprise is developed and a consolidated deed of transfer is formed.

How to finalize the merger process?

The merger procedure in comparison with the acquisitions is more complicated, time-consuming, and voluminous. In addition, all actions are taken in an acquisition take place in the context of a merger. Therefore, there is the composition of the stages for the merger:

- approval of the decision on the merger by the governing body of each company;

- notification of the Federal Tax Service Inspectorate of the intention to merge the companies;

- publication of an announcement of intent to unite in the media. Notification of counterparties;

- informing employees;

- obtaining approvals if necessary;

- taking inventory and forming a deed of transfer;

- appointment of a joint meeting of participants of all merged companies (shareholders, for example);

- collection of documents and payment of duties;

- submission of documents to the inspection;

- obtaining a certificate of the establishment of a new company.

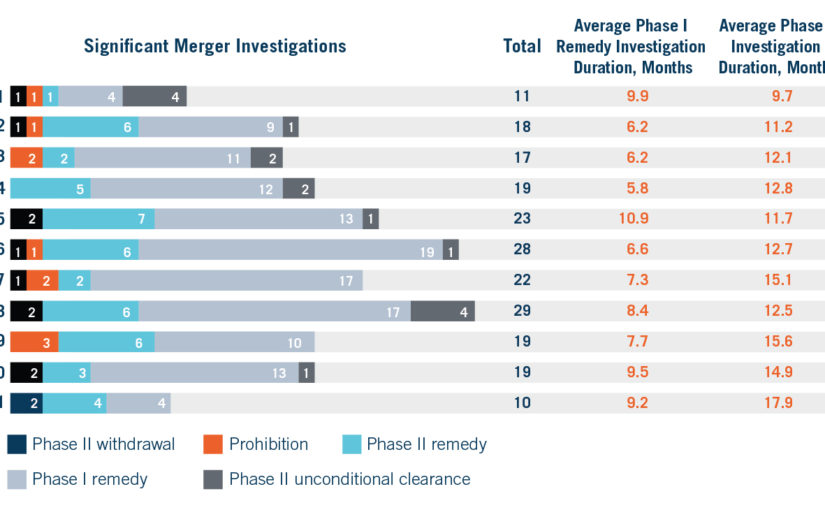

The procedure depends on the scope of work, M&A software implementing, the presence or absence of creditors’ consent to transfer the debt, the need to agree on the reorganization, and can last on average from three months to a year.

Legal diligence

This process takes from a couple of weeks to a couple of months. The company’s lawyers must prepare:

- Virtual Data Room. An online archive that stores all documentation for the target enterprise. Conclusion based on the results of the assessment of legal risks. It identifies material risks above the specified amount and how to solve potential problems. The conclusion should also contain:

- detailed analysis of the structure of the target enterprise;

- the order of its functioning;

- discovered defects in corporate governance;

- data on corporate property, etc.